Ponzi schemes, a term that has become synonymous with financial fraud, have left many individuals devastated, their hard-earned savings vanished into thin air.

In this personal exploration, we delve deep into the intricate web of Ponzi schemes, unraveling their deceptive nature, exploring their historical roots, dissecting their mechanics, and shedding light on the devastating consequences they inflict on unsuspecting victims.

Through personal anecdotes, real-life examples, and expert insights, we aim to arm readers with the knowledge needed to protect themselves and their loved ones from falling prey to these insidious scams.

Chapter 1: Understanding Ponzi Schemes

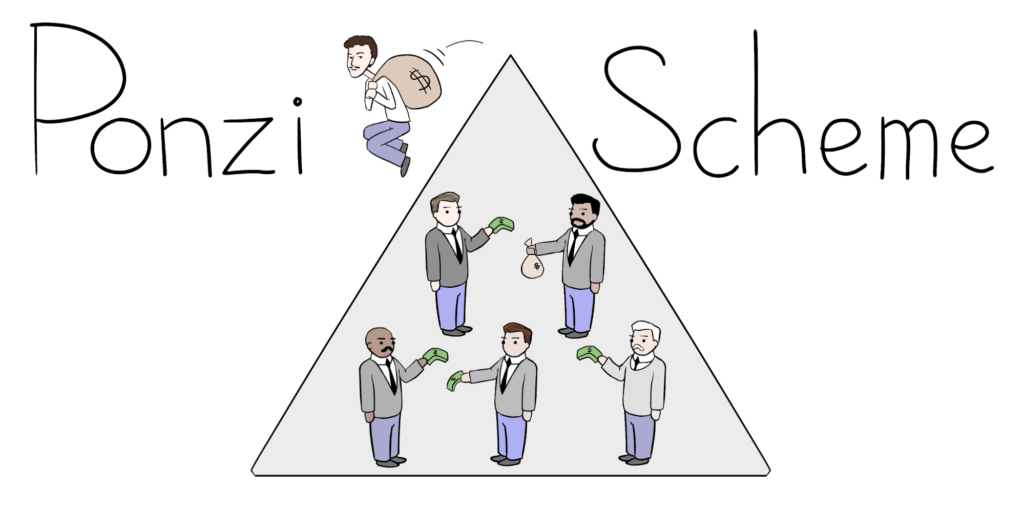

Ponzi schemes are fraudulent investment schemes that promise high returns with little to no risk.

They operate on the principle of using funds from new investors to pay returns to earlier investors, creating the illusion of profitability.

However, this unsustainable model inevitably collapses when the scheme operator can no longer recruit enough new investors to sustain payouts, leading to massive losses for participants.

Keywords: Ponzi scheme, fraudulent investment, high returns, unsustainable model, collapse.

Chapter 2: Historical Roots of Ponzi Schemes

The term “Ponzi scheme” derives from Charles Ponzi, an Italian immigrant who perpetrated one of the most infamous financial frauds in history during the early 20th century.

Ponzi promised investors massive returns by exploiting international postal reply coupons, but in reality, he was using new investors’ money to pay off earlier investors.

Ponzi’s scheme eventually collapsed, leading to his arrest and imprisonment.

However, his legacy lives on, with countless variations of his scheme emerging over the years.

Keywords: Charles Ponzi, international postal reply coupons, financial fraud, legacy.

Chapter 3: Mechanics of a Ponzi Scheme

Ponzi schemes typically involve a charismatic leader who entices investors with promises of extraordinary returns.

These leaders often rely on social connections, persuasive tactics, and false testimonials to lure in victims.

Once investors contribute their funds, the scheme operator uses a portion of the money to pay returns to earlier investors, creating the illusion of legitimacy.

Meanwhile, they siphon off a significant portion of the funds for personal enrichment.

As the scheme grows, the operator must continually recruit new investors to maintain the facade, until it inevitably collapses under its own weight.

Keywords: Charismatic leader, persuasive tactics, false testimonials, illusion of legitimacy, personal enrichment.

Chapter 4: Warning Signs and Red Flags

While Ponzi schemes may initially appear lucrative, there are several warning signs that investors should watch out for.

These include consistently high returns with little to no risk, reluctance or inability to provide detailed information about the investment strategy, and pressure to recruit new investors.

Additionally, investors should be wary of schemes that rely heavily on recruitment commissions or operate in unregulated or offshore locations.

By staying vigilant and conducting due diligence, investors can avoid falling victim to Ponzi schemes.

Keywords: Warning signs, red flags, due diligence, high returns, recruitment commissions, unregulated locations.

Chapter 5: Real-Life Examples and Case Studies

Throughout history, numerous Ponzi schemes have captivated the public imagination with their audacity and scale.

From Bernie Madoff’s multi-billion dollar investment fraud to the collapse of the MMM scheme in Russia, these examples serve as cautionary tales of the devastating impact of Ponzi schemes on individuals and communities.

By examining the mechanics of these schemes and the factors that contributed to their downfall, we can gain valuable insights into how to recognize and avoid similar scams in the future.

Keywords: Bernie Madoff, MMM scheme, cautionary tales, devastating impact, recognition, avoidance.

Chapter 6: Consequences of Participating in Ponzi Schemes

The consequences of participating in Ponzi schemes can be severe and far-reaching.

Not only do victims suffer financial losses, but they also experience emotional distress, shame, and embarrassment.

In many cases, victims lose their life savings, retirement funds, and even their homes.

Moreover, the fallout from Ponzi schemes can extend beyond individual investors to affect entire communities, leading to mistrust, regulatory scrutiny, and reputational damage.

Recovering from the aftermath of a Ponzi scheme can be a long and arduous process, requiring resilience, support, and, in some cases, legal action.

Keywords: Financial losses, emotional distress, reputational damage, regulatory scrutiny, legal action.

Chapter 7: Protecting Yourself from Ponzi Schemes

Protecting yourself from Ponzi schemes begins with education and awareness.

By familiarizing yourself with the warning signs and red flags, conducting thorough research before investing, and seeking advice from trusted financial professionals, you can reduce the risk of falling victim to fraudulent schemes.

Additionally, diversifying your investments, avoiding investments that promise unrealistic returns, and staying skeptical of unsolicited offers can help safeguard your financial well-being.

Remember, if something sounds too good to be true, it probably is.

Keywords: Education, awareness, diversification, skepticism, safeguard, financial well-being.

Conclusion:

Ponzi schemes continue to pose a significant threat to investors around the world, exploiting greed, desperation, and trust for personal gain.

By understanding the mechanics of these schemes, recognizing the warning signs, and taking proactive steps to protect yourself, you can avoid becoming another victim of financial fraud.

Remember, the promise of easy money often leads down a path of deceit and destruction.

Stay vigilant, stay informed, and above all, trust your instincts when it comes to investing your hard-earned money.

Keywords: Threat, exploitation, vigilance, information, instincts.